by Dr. Stacy Feiner

Impact investing is more than a financial strategy—it’s a vehicle for strengthening the emotional and relational fabric of family enterprises. Unlike conventional investments that focus solely on financial returns, impact investing aligns capital with values, purpose, and shared legacy. In family systems, where identity, power, and belonging are tightly interwoven, this alignment becomes a powerful force for cultivating relational health.

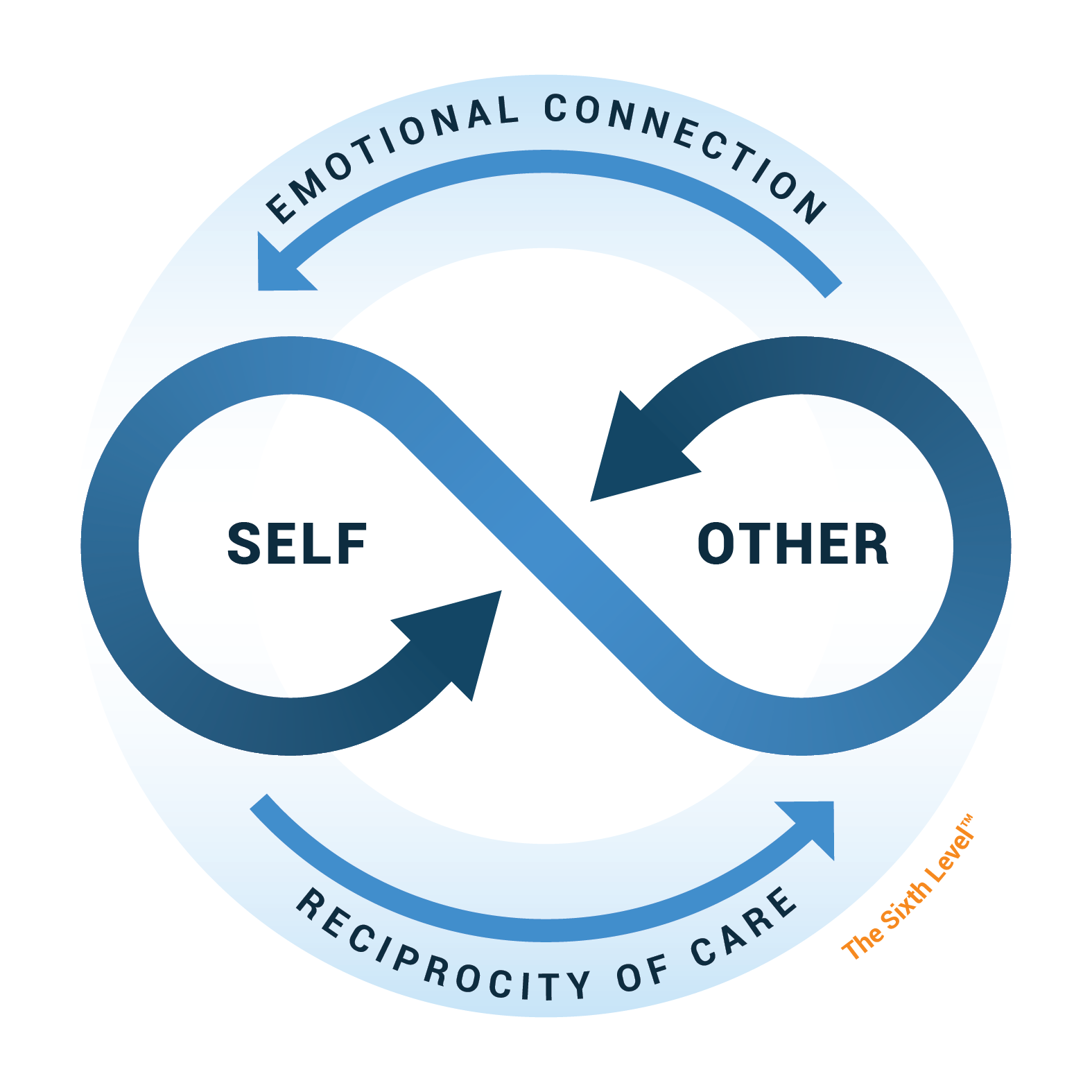

Relational health refers to the strength and quality of the relationships that hold a family enterprise together. It’s what determines whether siblings become allies or adversaries, whether a rising generation feels trusted or sidelined, and whether the enterprise thrives across generations or quietly unravels. Impact investing, by its nature, invites families to engage deeply—with one another, with the community, and with the outcomes of their wealth. That act of engagement creates the conditions for honest dialogue, shared vision, and emotional accountability.

Within this process, a relational steward can play a vital role. Positioned inside the governance structure, the relational steward facilitates impact investing as one of several tools for advancing family well-being. Alongside practices that make up the ethic of care, impact investing becomes a shared endeavor—one that strengthens relationships while advancing purpose. The presence of the Relational Steward ensures families surface tensions, build trust, and translate intention into unified action.

When families invest in outcomes that matter to them—and pair that investment with a focus on how they work together—they build capacity for tough conversations, quicker decisions, and sustained unity. This is care work. It’s strategic. Impact investing done well doesn’t just create external impact—it forges internal alignment. And for family enterprises, that’s the foundation of long-term success.

🔗 Explore more perspectives: